It might feel like a big expense, but if you can afford it, involving a financial professional in your business can be a worthwhile investment. And, you’ll thank yourself later when you can sleep well during tax season. As a new small business owner or freelancer, you might be thinking that it’s more affordable to file taxes yourself. Why spend on a CPA if you’re not even sure how much income you’ll make anyway.

Contrary to popular belief, accounting and tax preparation are two completely different services. Hiring a CPA firm to do your taxes will typically cost more than tax software — but you have the potential to save a lot more in taxes over time. Many CPAs charge an hourly rate for some tasks in addition to your tax returns’ flat rate. Because there’s more that goes into doing a tax return than just filling the numbers. Things like stocks, real estate and multiple business entities can complicate your personal and business returns.

Factors affecting CPA costs

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. If you’re on a budget (and what small business owner isn’t?), here are some things you can do to make working with a CPA more affordable. According to ThePricer.org, forensic accountants typically charge anywhere from $300 to $500 per hour. Growing small businesses inevitably meet the challenge of their internal accounting methods no longer being sustainable.

Since those factors make your return more complicated and take more time to get right, CPA firms typically charge more for them. On top of that, many CPAs don’t know what costs might come into play until they actually start doing your return. Here are some of the biggest factors that could increase the cost of working with a CPA firm. Hiring a Certified Public Accountant for your LLC can provide valuable financial expertise and ensure compliance with complex tax regulations.

CPA Exam Approximate Total Cost

The cost of tax preparation can vary depending on the type of return. For instance, corporate tax returns (Form 1120) average $903, How much does a cpa cost while Schedule C costs around $192. CPA exam

Total exam cost varies based on jurisdiction, application, section and re-take fees.

Ask them questions about their rates, hours of operation, customer service, and any discounts offered. As a reputable and reliable service, 1800accountant offers the expertise of Certified Public Accountants (CPAs) dedicated to helping your LLC thrive financially and at an affordable price. A CPA’s primary goal is to help you make smart financial decisions that will benefit your business now and in the future. Fees will also depend on how much work will be involved in completing your tax return.

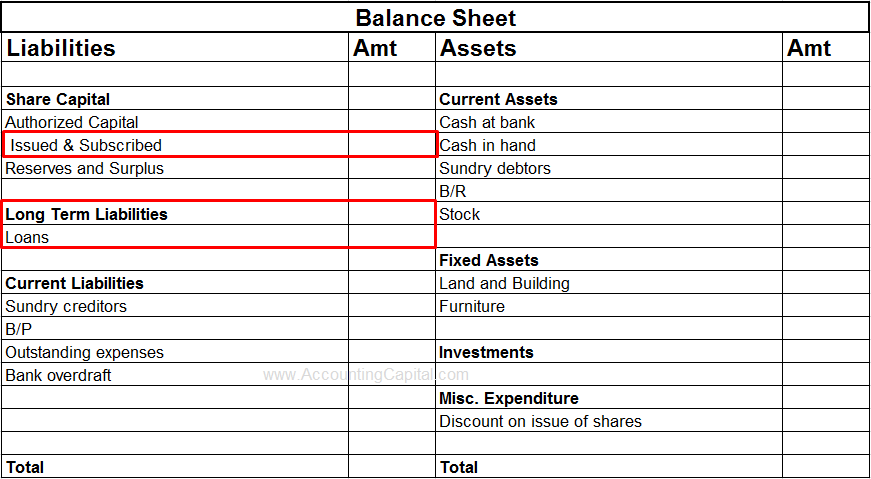

Check Weekly Offers on Princeton Review SAT Courses

We are always willing to talk about your unique needs and look forward to hearing from you. Contact us today to get started with hassle-free accounting services. Outsourcing non-core business functions have become increasingly popular as technology improves and businesses realize the benefits of focusing on core competencies. In fact, accounting tasks are some of the most popular functions to outsource, in addition to the 50% of small businesses that outsource payroll. You can organize your books by reconciling your accounts, correcting your balance sheet and income statement and using accounting software. However, the benefits of professional accounting and tax assistance can outweigh the expenses.

An accountant’s hourly pay depends greatly on the geographical location where they work in. CPAs in areas like California or New York cost much higher than in the Southeast or Midwest. If you withhold important information it may affect tax preparation and errors may occur. CPA determines the best way to handle the financial crisis and maintain the client’s privilege in the event of tax litigation. In case you are interested in doing the taxes on your own, you better start with the accounting software. If you are the owner of a small business or a freelancer, you might think of doing your own taxes.

Keep in mind, as the CPA Exam changes in 2024, some of these costs may change. Your total CPA Exam cost depends on a few factors, including your location and what study materials you use for the exam. If you’re planning your budget for professional development as an accountant, this is your guide for CPA Exam costs and other fees related to CPA licensure. Outsourcing makes it easy for any business, of any size, to get all the services and solutions of a larger corporation, but without the investment in staff, training, and so forth.

3% Social Security COLA Estimated for 2024 – CPAPracticeAdvisor.com

3% Social Security COLA Estimated for 2024.

Posted: Thu, 20 Jul 2023 07:00:00 GMT [source]

Remember, the hourly cost of hiring a CPA depends significantly on the type of work you need them to do. As you might expect, the more complex and involved the work, the higher the hourly rate is likely to be. Fortunately, small businesses usually don’t need to hire a CPA full-time. Most can get by paying for CPA services intermittently throughout the year, such as calendar year-end, tax season, and before significant decisions. A Certified Public Accountant (CPA) is one of the most beneficial service providers you can hire as a small business owner. In addition to helping you complete and file your annual tax return, they can provide valuable tax and business planning during the year.

Is Hiring A CPA Worth It?

Most states specify that you must have a bachelor’s degree in accounting. Furthermore, a degree in business could also help you to meet the eligibility criteria. If your application is approved, you will receive an authorization to test (ATT) notice.

SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. They have specialized knowledge of tax laws and can find deductions, credits, and exemptions to lower your tax liability. They handle complex tasks, paperwork, and tax filings accurately, allowing you to focus on other important aspects of your life or business. The average CPA price for specific services depends on many factors, but here are some examples.

- We see syndications make huge mistakes when budgeting for accounting fees.

- Most states specify that you must have a bachelor’s degree in accounting.

- Remember, the hourly cost of hiring a CPA depends significantly on the type of work you need them to do.

- They also ensure that you adhere to applicable tax rules for business owners.

- The application fee is a one-time fee paid to your state board to apply to take the CPA Exam.

- According to the National Society of Accountants, a Form 1040 with a state return, Schedule A, and Schedule C costs an average of $481 to have a CPA prepare your taxes.

We’ll break down the cost of online accounting and CPA services, so you know what to expect for your business. Most states require you to take 40 hours of continuing education each year. Depending on what platform and provider you use for your CPE, it could cost $20 per hour on up to $125 per hour.

Here are the average hourly costs for some popular CPA services. CPAs and related professionals are the only ones that can represent taxpayers in a tax dispute or an IRS audit so it is worth hiring a CPA to avoid such problems. Professional CPAs are needed for auditing financial statements and only they can issue an auditor’s report and audited financial statements. The smaller your overhead costs, the more profits you get to keep. You don’t want to cut corners, but you should look for cost-effective solutions that fit your business’s needs.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. We tried the subscription model by quoting a client for a certain number of phone calls annually and then spreading out the cost over 12 months.

If you need a CPA specializing in business tax filing, call MI Tax CPA. Our experts will work to find every deduction for your business and help you save. Today, some CPAs work remotely, so they may be able to help you prepare your business taxes from somewhere else, even if you are in a metropolitan area. Our tax strategy engagements now last 12 months days and can cost as much as $10,000.

In case of lots of deductions, donations, expenses, and so on, you need to manage the files and keep your document organized to lower the CPA cost. So if you are looking for tax preparation, clean up the books, and arrange them by making them financially presentable, then you can expect to pay your CPA a little extra. Your financial service fee depends on the work you need to be done.

Also, it depends on whether the accountant is employed for personal or company use. It’s crucial to note that even if their rate surprises you, any CPA worth their salt knows the value of their job and is used to charging the prices they quote. This is a good time to ask your CPA how you can make the process easier for them (and thus save money) for next year if the price seems out of line. Tax preparation is a service many CPAs charge based on how much time and effort it takes them to complete your taxes. As a result, you may be n a situation where you and your CPA can’t agree on the final fee.

Selecting the right QuickBooks version for your LLC can aid in meticulous bookkeeping, expense tracking, and tax filing. If you want to view a list of CPA firms in your area, search Google and type ” CPA firms” and your location. After you have found a promising CPA firm, read the company’s website thoroughly to find out what they offer clients. You can also verify credentials and qualifications, ensuring the consultant is a certified tax professional with relevant experience. By leveraging their skills and upholding professional standards, CPAs provide reliable financial guidance and contribute to the success of organizations and individuals alike. CPAs also use their extensive knowledge of the tax code to help people plan for their future personal and business financial needs.

Hiring a CPA can help in complying with all the requirements making you ready for an eventual initial public offering (IPO). If you work with the same CPA firm or individual all year long, they become familiar with your business workings and how you operate. They can spot the inconsistencies right away that otherwise may affect your books. Your CPA can also provide customized advice and help the business boom.